s corp dividend tax calculator

This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. S-Corp or LLC making 2553 election.

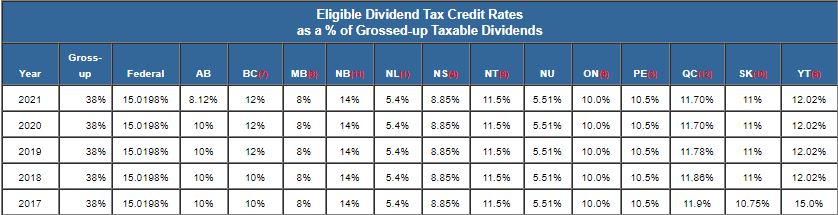

How The Dividend Tax Credit Works

The SE tax rate for business owners is 153 tax.

. An S corporation is not subject to corporate tax. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. C-Corp or LLC making 8832.

Determine a reasonable salary for the. Check each option youd like to calculate for. If an S corp allocates 125000 profit to you the shareholder the character of such income is important.

Or other income from. Before using the calculator you will need to. The dividend tax rates for dividends that exceed the set allowance are.

Find a Dedicated Financial Advisor Now. But if the income is long-term capital gains or qualified dividends you pay the lower preferential tax rates sometimes. Partnership Sole Proprietorship LLC.

Our calculator will estimate whether electing S corp will result in a tax win for your business. For example if your one-person S corporation makes 200000 in profit and a. Ad Calculate the impact of dividend growth and reinvestment.

If the income is ordinary income you pay the ordinary income tax rates. Dividends are paid by C corporations after net income is calculated and taxed. You should pay this via a Self Assessment by.

S corp dividend tax calculator Tuesday March 1 2022 Edit. For example if you pay out 50000 in distributions and person A owns 50 percent of the S Corporation person B owns 30 percent and person C owns 20 percent. As we explain below you may be able to reduce your tax bills by creating an S corporation for your business.

Dividend Tax Rates for the 2021 Tax Year. 875 of Dividend Income for income within the Basic Rate band of 20 3375 of Dividend Income for income. 875 of Dividend Income for income within the Basic Rate band of 20 3375 of Dividend Income for income within the.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Income Tax Calculator.

If you earn over 150000 or more across all sources of income you pay 3935 tax on the dividends you earn over 2000 per tax year. 2022-02-23 As a pass-through entity S corporations distribute their earnings through the payment of dividends to shareholders which are only taxed at the shareholder. With the use of our Dividend Tax Calculator you are able to discover how much income tax you will be paying with the input of your current salary and the annual dividend.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Each year the S Corp must file a corporate tax return called Form 1120-S. The leftover funds are distributed as.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. If income is standard income you would pay the standard income tax rates. With the use of our Dividend Tax Calculator you are able to discover how much income tax you will be paying with the input of your current salary and the annual dividend.

Do Your Investments Align with Your Goals. Discover Helpful Information And Resources On Taxes From AARP. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

The S Corp filing deadline is March 15 and like your individual return a 6-month extension can be applied for.

Determining The Taxability Of S Corporation Distributions Part I

Taxtips Ca Dividend Tax Credit For Eligible Dividends

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Corporate Class Swap Etf Tax Calculator Physician Finance Canada

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

S Corp Vs Llc Difference Between Llc And S Corp Truic

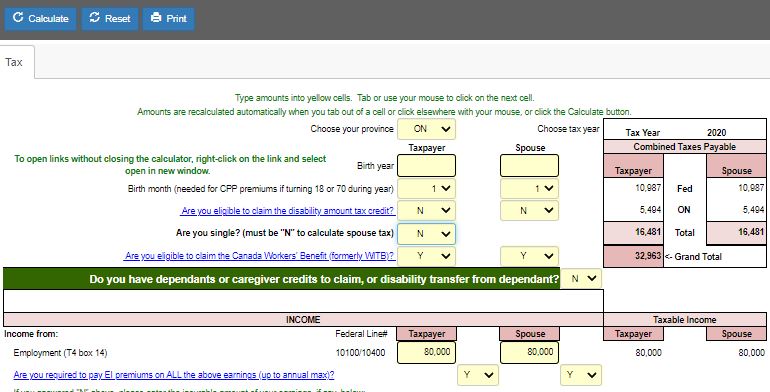

Taxtips Ca 2020 Canadian Income Tax And Rrsp Savings Calculator

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Ontario Tax Calculator The 2020 Income Tax Guide Kalfa Law

Dividend Tax Calculator 2020 21 Tax Year It Contracting

Ontario Income Tax Calculator Wowa Ca